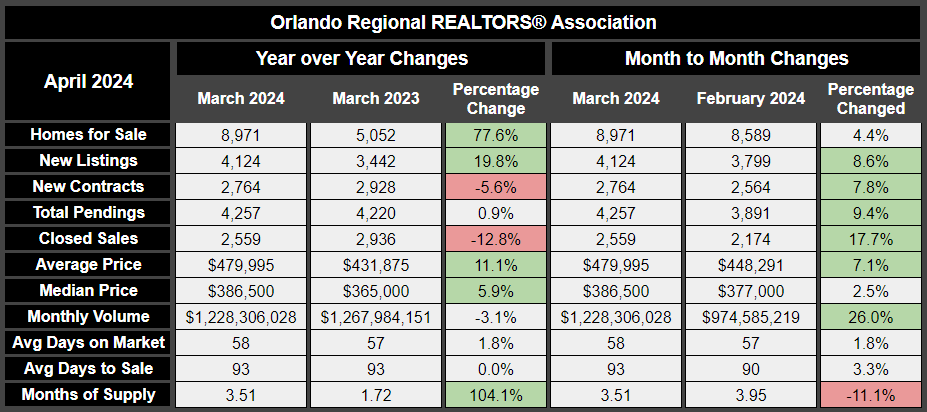

Housing Market update in Orlando for April 2024

Another month has come and gone, and the 1st quarter did as we expected. For the 3rd month in a row, the median price point has increased, coming in at $386,500; 2.5% higher than the previous month, and 5.9% higher than last year. Our current inventory is just shy of 9,000 homes and is the most homes for sale since July 2017. In July 2017, the interest rate was 4% and median price point was $220,000; a very different market than our 7% interest and $386,000 median price point. In spite of the affordability to get into a home being at an all-time high, our market continues to thrive with growth in many of the leading measures; including new listings, new contracts, pending and sales.6 Things you can do today to help offset the challenges of affordability:

- Hometown Heroes – The state of Florida releases $100,000,000 on July 1st to first-time homebuyers. This program can assist you with downpayment assistance, closing costs, up to $35,000 or 5% of your purchase price

- Pre-pay your interest rate. You may have heard about 5 year ARMs (adjustable rate mortgages) or 3-2-1 buy downs. These may be great solutions for you, TODAY, however, make sure that they are not based on “hoping” that the rates will reduce. Talk with a professional and put the numbers on paper

- Seller’s can offer concessions back to buyers to help in closing costs. Ask your REALTOR® if it is a good idea for you and add it to your offer.

- Higher downpayment. This might be easier said than done, however, if you have cash, then you don’t have an interest rate

- Shop your insurance.

- If you are moving from another home in Florida, you can port over the equity that has built up in that home, and reduce your taxes.

Submit your review | |

The Bosley Team - Real estate Solutions

Average rating: 0 reviews